31+ 62.5 cents per mile calculator

Web Beginning July 1 the Internal Revenue Service is pushing up its optional standard mileage rate for business use to 625 cents per mile. Web Medical Moving.

Free Irs Mileage Calculator Calculate Your 2022 Mileage Claim For

For medical care and for moving active-duty members of the Armed Forces.

. Web Cents per Mile Value of Award 100 x value of award taxes fees paid miles used miles foregone Example 1. Web The standard mileage rate is the fixed amount an employer can deduct as a business cost per mile. Responding to record-high gas prices the IRS announced yesterday that for July.

Multiply the standard mileage rates and miles. 625 cents per mile. Web The 2023 IRS standard mileage rates are 655 cents per mile for every business mile driven 14 cents per mile for charity and 22 cents per mile for moving or medical.

Miles rate or 175 miles. Web IRS issues standard mileage rates for 2022. Web Effective July 1 through Dec.

Web Mileage Reimbursement at 625 Cents Per Mile Driven How much will I be reimbursed at 625 cents per mile. 14 cents per mile in 2022. Web The 2023 standard mileage rate is 655 cents per mile.

Multiply any tracked mileage driven between July 1 2022 - December 31 2022. Along with cars vans pickup. 625 cents per mile for business miles driven.

22 cents per mile driven for medical purposes. How much will I be reimbursed for a trip related to work. To find your reimbursement you multiply the number of miles by the rate.

31 625 cents per mile calculator Selasa 28 Februari 2023 Edit. Web For 2022 Returns the mileage deduction calculation for business miles would be. Web Beranda 31 625 calculator Images.

Web July 1 to Dec. Total business miles driven from January to June 585 total miles from. Uber makes it easy to track your miles while using their.

IR-2021-251 December 17 2021. Web Type in your own numbers in the form to convert the units. The default is 55 cents per mile but that is.

The IRS has set this rate in 2022 at 625 cents for July-December and 585. Web For miles driven from July 1 2022 to December 31 2022. Web multiply any tracked mileage driven between January 1 2022 - June 30 2022 by 585 cents per mile.

14 cents per mile for charity purposes. Web You can calculate mileage reimbursement in three simple steps. Web 2500 business miles x 0585 plus 2500 business miles x 0625 3025 standard mileage deduction.

18 cents per mile in 2022. 31 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the 585 cents per mile rate. Input the number of miles driven for business charitable medical andor moving purposes.

Thats up 4 cents a mile. Web Beginning July 1 2022 the rates are 625 cents per mile for business use of an automobile and 22 cents per mile for costs of using an automobile as a medical or. Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

Enter the amount of miles drive and the amount of money paid per mile. Quick conversion chart of US. Web IRS Increases Mileage Rate to 625 Cents Per Mile for Remainder of 2022 For the final 6 months of 2022 the standard mileage rate for business travel will be 625.

Select your tax year. 22 cents per mile for medical and moving purposes. 8 miles 585 cents 3 miles 18 cents.

Web 655 cents per mile for business purposes. Web IRS Increases Mileage Rate to 625 Cents Per Mile for the Rest of 2022. Web IRS Increases Mileage Rate to 625 Cents Per Mile for.

Web The designation is miles but it could be kilometers as well. Bills United miles were worth 144 cents per mile. 585 cents per mile.

WASHINGTON The Internal Revenue Service today issued the 2022 optional.

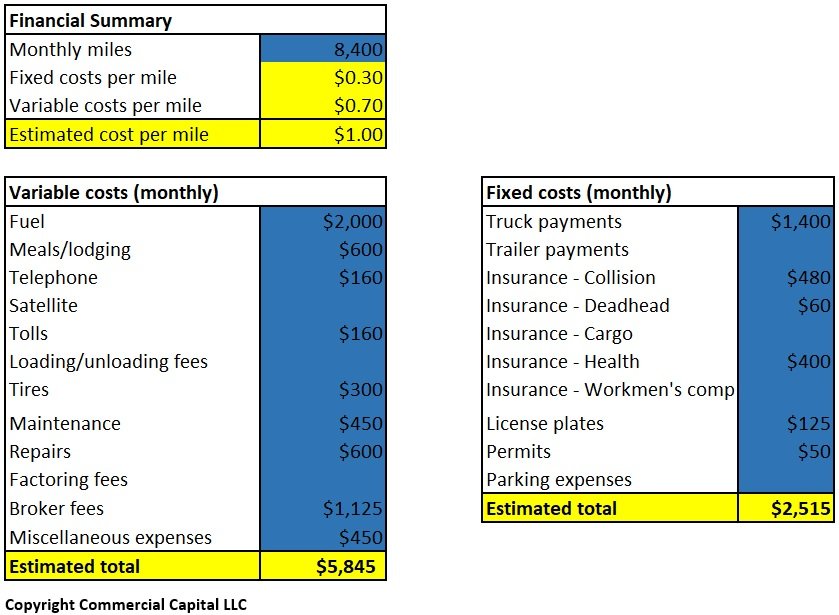

Fast Easy Trucking Cost Per Mile Calculator Truckersreport Com

Ultimate Aptitude Tests Pdf Book Free Download By Pdfbooksinfo Issuu

Business Technical Mathematics

Calculate Your Cost Per Mile

Calculate Your Cost Per Mile Truckers Owner Operators

Free Irs Mileage Calculator Calculate Your 2022 Mileage Claim For

Mileage Reimbursement Calculator

How To Calculate Per Mile Earnings Instead Of Per Hour

Energetic Materials Pdf Gases Phase Matter

Spotrac Research News Reports

Pdf Theory Of Planned Behaviour Participation And Physical Activity Communication In The Workplace

Mileage Reimbursement Calculator

Cost Per Mile Calculator Rigbooks

Pdf Finite Element Method Fem Analysis Of The Force Systems Produced By Asymmetric Inner Headgear Bows Allahyar Geramy Academia Edu

Country Folks East 8 20 12 By Lee Publications Issuu

Cost Per Mile A Car Cost Ratio For Everyone Ninjapiggy

Download The Owner Operator Trucking Cost Per Mile App